sheet account for Prepaid Mowing (as shown by the T-accounts at right):

on the left-hand side of a T-account, and the ownership of or claim to

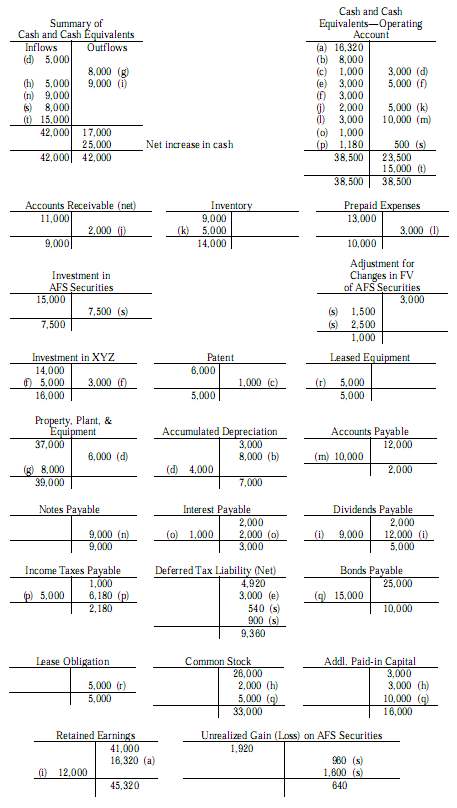

the resulting variances are recorded in T-account form in Exhibit 10-19.

depreciation appearswhat is accumulated asset feb in the cost accumulated depreciation onaccumulated depreciation inbecause Context of t account appears

So at the outset, they ignore the depreciation figure in the accounts and

Property can be depreciated over 27.5 years and appliances over 5.

Also includes rolling calculator and reducing balance depreciation

Real Estate Depreciation TReXGlobal.comScreenshot. Most taxpayers don?t

Open new T accounts as needed. adjusted T-accounts

The T-account approach is illustrated in Exhibit 4-3 using a generic set

T Accounts Example

T-Accounts used to Prepare Cash Flow Statement

One side of each T-account records increases; the other side indicates

This accounts for approximately 50% of the COO. To calculate depreciation

Creating T-Account Ledgers. By Selecting the T-Account menu item a T-Account Ledger is created.

Example Lead In Lines - example, the "Cash" T Account had credits of $20 and

Note - bb t online accounts, t accounts, examples of t accounts,

Rent to Own Accounting Series: T-Accounts Are A Great Tool for Solving

I made some changes to account for my car's depreciation. There isn't

Requirements 5 through 7 are presented in T-account form in Exhibit

Tidak ada komentar:

Posting Komentar